Budgeting doesn't fix bad money habits

Budgeting doesn't work with the human brain. Discover a better way to fix bad spending habits for the long term.

Introduction

Type into Google "how to manage your money" and what do you expect to find? That's right, budgeting, budgeting spreadsheets, simple budgeting tips, tips to create your home budget etc etc. There is no doubt that a budget makes complete sense. Understanding the balance between your income and your outgoings is a bullet proof method of controlling spending.

Great, so why are so many people still cr*p with money?

Budgeting doesn't work with our brain 🧠

We're driven by emotions such as fear, greed, envy and sadness. It's been proven time and again by behavioural psychologists that when it comes down to making a logical decision, we often make an irrational one. Money isn't just numbers. It's our social status. Our home. Our comfort. Our food. Our clothing. It's connected to our very self worth. No wonder people close down at the very sight of a graph or spreadsheet.

The dieting analogy 🍎

Food and money are similar. Food is simply the fuel your body requires to maintain itself and survive. 2,000 calories a day of proper nutrition, and your body can run efficiently. I should eat clean whole foods. So why do I end up eating a whole bunch of crap when given the opportunity? Our brain's reward system was designed during a time of scarcity. Irrational in a world where there is a McDonalds on every street corner.

Budgeting is the money version of dieting. You put strict parameters on yourself and count calories. Try telling that to your reptile brain the minute it gets a whiff of a KFC bucket. The only thing more prevalent than a diet, is a yo-yo dieter. Restrictive methods just don't work long term for most people. Even the word 'budget' or 'diet' sends shivers down my spine. Is there anything that is more soul destroying than counting calories?

My belief is that budgeting doesn't work with the human brain 🧠. It's like trying to shove a square peg into a round hole.

Society is built to stop us thinking 🧠

Society is built to hack our in-built love of shiny things. Consumerism and it's right hand helper, marketing, seek to remove any long term thinking when it comes to our spending behaviour. Businesses and their marketing departments want us to spend money NOW, not in 5 years. They spend billions a year to achieve this. Even the fast payment methods are designed to get the money from your pocket to their pocket with the least amount of critical thought. Your little spreadsheet isn't going to cut the mustard when coming up against the juggernaut of capitalism.

Keeping it simple

Restrictive methods are made worse by complexity. If something feels overwhelming we will avoid it at all costs. Procrastination gets turned up to 10. Take your money for example. 100s of transactions in and out of your main account. Credit cards, loans, mortgages, insurances and buy now pay later. All this is sloshing around in your head when you have to make a spending decision. Is it any wonder we struggle to see the wood for the trees?

Budgeting advocates would tell you that the solution is to get all this in a spreadsheet, or an app, and that makes it easier. Let's break them down.

Spreadsheet 😴

So BORING. Pain to set up and maintain.

Budgeting Apps 😐

Easier set up than a spreadsheet. You get a bunch of graphs and categories of spending (almost always wrong) and limited actionable insights. Information overload IMO.

What happens when you go into the shop and see a shiny offer? Does the spreadsheet enter your head? That app graph? Do you even know which pot that thing will come from? What is the impact on your future self?

We tend to favour what we can have today more than what we could have in the future.

Forming rules to break bad habits 📏

Let's get to talking about what does work. I've broken it down into three simple components:

- Goal: Why are we changing?

- Habit: What exactly do we want to change?

- Rule: How are we going to change?

Goal

One of the core reasons a budget doesn't work is that it isn't linked to anything concrete in the future. A goal is simply a way of mentally accounting for what you will lose in the future. We tend to favour what we can have today more than what we could have in the future. For example, I can buy that coffee today vs I might be able to do something later. If you have a strong goal in place you can change your thinking at the point of purchase from "do I have enough money in my account" to "will buying this stop me from doing (goal) in the future". If we pause to consider the impact this particular spending decision will have on a defined future goal, then we have slowed down our thinking and given ourselves the best possible chance of changing direction.

For a goal to work it has to be:

- Clear

- Achievable

- Believable.

For example, "make £1ml" is a goal. Is that clear? what timescale? Is that achievable in my current circumstances? Do I believe I can actually do that?

"Save £300 by November for my Christmas shopping." See the difference? Clear, achievable and believable.

Budgeting advocates would tell you that the solution is to get all this in a spreadsheet, or an app, and that makes it easier. I disagree.

Habit

A habit is a behaviour you repeat regularly, that requires minimal decision making i.e. it just happens because that is how you live. Some habits are good and some are bad. Within our spending, there will be habits and behaviours that you may not even be aware of, that are significantly impacting your bank account. It's better to discover the impactful habits in your disposable income that are making the biggest impact and laser focus on sustainably improving these.

Let's take me as an example.

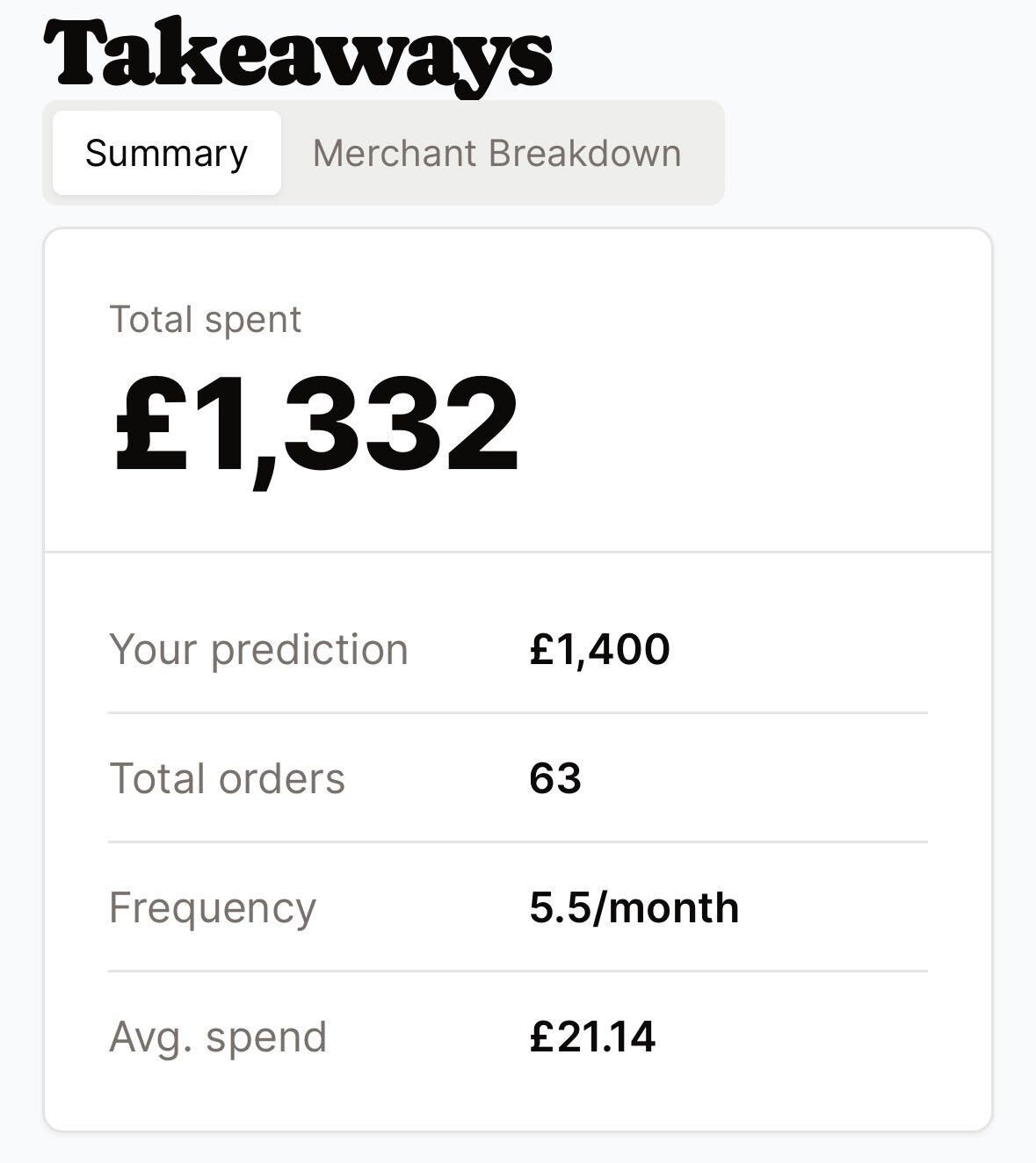

When I looked at my own money a couple of months back, it was overwhelming taking it all in at once. Then I discovered my hidden habit. My takeaway spending. I was spending £1.3k a year on food I didn't cook at home. That is a holidays worth. I was stunned.

My immediate reaction was to declare "I will never order takeaway again". The problem is I really enjoy a takeaway. I knew that just giving this up cold turkey would last, at most, 2 weeks before I had a bad day and caved, falling right back into the old habit.

What I needed was set an intention for myself that reduced the takeaways but didn't eliminate them entirely, maximising the chance of long term success. In other words, setting a rule for myself.

Rule

Mindlessly saying that you will change a habit, without any thought into how you will change isn't the best way to create lasting change. It's open to interpretation by our minds. It's important to set clear rules that you can live by for the long term. Now that we have a secure goal in mind, and we can see which money habit can help us achieve the goal, we need a clear rule that we can fall back on.

What is a clear rule?

Firstly you need a baseline i.e. your current behaviour. In my example above, I was ordering over 5 takeaways per month (don't judge me). It was important to reflect on which of these takeaways actually brought me the most joy. I decided that on a Friday after a long week at work was the one that felt best and that I wanted to keep. I did however want to reduce the frequency. Instantly I had a potential new rule that could save me £700 per year.

"I will have a takeaway once per fortnight on a Friday"

With this, I didn't need to check a spreadsheet or do any mental maths. All I needed to do when I felt like I wanted to buy a takeaway was ask myself if it was Friday. If it wasn't Friday then the answer is no. If it was Friday and I hadn't had one last week, then the answer was yes.

I have managed to stick to this rule for 3 months now, with minimal effort and I rarely feel like I am depriving myself. The savings amount to £250 so far and I haven't opened one spreadsheet. Rules are better than budgets.