The Budget Spreadsheet: How to Manage Your Money

Download our free budget spreadsheet: Get tips on managing your money and download a free money health check spreadsheet.

Almost all advice out there will tell you to create a budget as a first step to managing your money. Most of the time these don't work long term, as things change and require flexibility. However, they can be a really useful tool to get a sense of how you are spending vs your current income. This guide will give you some helpful tips as well as offering you a FREE budget spreadsheet.

Some tips to read before using our free budget spreadsheet

There are many different long term budgeting techniques to choose from, such as the 50/30/20 budget. Whichever you choose, it's a useful starting point to get a handle on your incomings and outgoings.

Before you start, here are some useful tips.

- Gather all statements and receipts

Guessing with a budget is pointless, and it is important to be as accurate as possible. To do so you are best looking at some real numbers. Get together your bank statement(s) as well as any receipts that may be helpful for inputting the most accurate information possible.

2. Decide who this budget is for

Is this budget for you alone, or does it include your partner. Very often it is pointless doing one just for you when your finances are connected. If it is for you and your partner, sit down and do it together. It will be worth it we promise!

3. Don't lie to yourself

Our brains can play tricks on us from time to time. This is more likely when it comes to estimating our spending. Most of the time we will underestimate the amount of money we spend on a category or on any one purchase. Be as accurate as possible. Your future self will thank you.

4. Don't forget those one-off costs

It is easy when filling in a budget to not include those costs that come up now and again such as birthdays and holidays. I suggest you take the cost and divide by 12 to give the monthly cost over a year and put it into your monthly budget.

5. Don't panic

If the numbers show you are spending more than you earn, sometimes we panic and bury our head in the sand. Don't. Now is the time to take a deep breath and dig into those numbers to see where you can cut some spend from your budget. Very often these are hidden in our day to day habits. Coffees, takeaways etc. Sometimes we have subscriptions we forget about and should cut. Either way there will be a way to get things back into the black again.

What to do if my budget is negative

You've done all the work and our spreadsheet has spit out a negative budget. It is really important that you take some action now otherwise you risk falling into a negative spiral of debt. Let's take a look at some steps you could take to get that figure looking healthier.

- Cut subscriptions

We live in an age where everything is a subscription and these build up. I have found myself forgetting about subscriptions I had until a year later. Look at all your subscriptions and direct debits. Be totally honest with yourself as to whether you really make use of this spend. Example: I had Disney plus for a year and hadn't cancelled it. I asked myself how many times I had watched it in the last month. It was a big fat zero, so I cancelled it. Do this with every single one of your regular payments and be ruthless.

2. Look at your food buying

Food is super expensive in 2023 and it isn't showing signs of going down. Now is a good time to look at how we shop and implement some strategies for saving on our food bill. You would be surprised how something a little as changing supermarkets can have a big impact on your bills.

3. Look at your daily habits

Love that daily coffee on the way to work? Two takeaways a week? Shopping on ASOS? These habits all add up to significant spending. Find a way to reduce these. Top tip: cutting our habits out completely rarely leads to success. Try setting a rule for reducing your habits. Example: you buy a coffee every day. Try only buying one twice a week on predefined days.

4. Sell some stuff

One person's trash is another person's treasure. Go around your house and find anything you haven't used in the last 6 months. Either start using it or sell it. This can really add up to a signficant little pot. Consider looking into the minimalist lifestyle for inspiration.

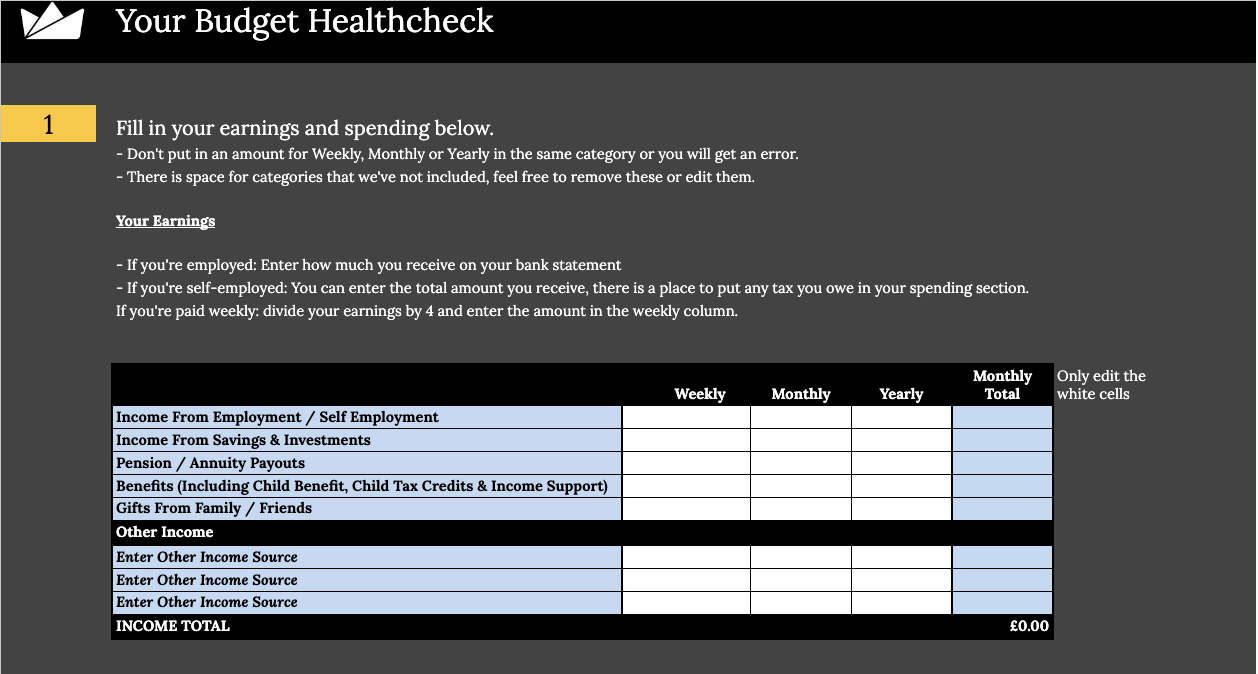

The free budget spreadsheet

We know not everyone is comfortable using a spreadsheet so we created a really simple budget spreadsheet to help you gain a quick financial health check. Simply click the link below and make a copy of the spreadsheet. If you would rather use Excel instead of Google Sheets, simply download in Excel format.