How ADHD Hyper-fixations can Impact your Money

In this blog post, we'll dive into how ADHD hyper-fixation can wreak havoc on your finances and three down-to-earth strategies to keep your wallet from taking a beating.

Introduction

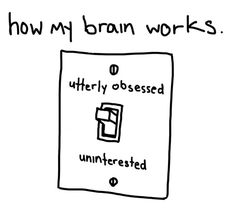

One of the more common symptoms of ADHD is how we tend to become hyper-fixated on particular hobbies, objects or activities. This can be a real superpower, like when you need to get a task completed and you become hyper-fixated on it which can lead to prolonged focus and productivity on that task.

It can however become an issue for our money when we hyperfixate on certain hobbies or consumer products. Especially when you consider that a lot of the time we tend to lose interest, and move onto something new in a heartbeat.

I can't say how many times in my life I thought I had found the perfect hobby for me. I bought all the equipment, only to lose interest two weeks later.

In this blog post, we'll dive into how ADHD hyper-fixation can wreak havoc on your finances and three down-to-earth strategies to keep your wallet from taking a beating.

Understanding Hyper-fixation and ADHD

Living with ADHD means riding waves of intense focus and impulsivity. Hyperfocus is when your brain grabs onto something and won't let go – it's like being glued to a topic or activity for hours on end. Sounds pretty cool, right? Well, not always, especially when it comes to managing your money.

How Hyper-fixation Hits Your Wallet:

Here's the deal – hyper-fixation and finances don't always play nice together:

- Spur-of-the-Moment Spending: Ever found yourself dropping cash on stuff related to your hyper-focus without a second thought? Yep, that's the impulsive spending side of hyper-focus rearing its head.

- Bills? What Bills?: When you're knee-deep in a hyper-focus session, paying bills or sticking to a budget might as well be on another planet. It's not that you don't care; it's just that hyper-fixation has you in its grip.

- All-In on Interests: Hyper-fixation can make you go all out on your interests, pouring money into hobbies or obsessions without considering the consequences for your bank account.

How to Take Control

Ready to stop hyper-focus from trampling all over your finances? Here are three real-world strategies to keep your money in check:

- Budget Like a Boss: Okay, hear me out – budgeting doesn't have to be boring. Set up a simple budgeting system that works for you, whether it's jotting down expenses in a notebook or using a budgeting app. Make sure to include a "fun money" category for hyperfocus-related splurges, but stick to it like glue.

- Hit Pause Before You Spend: Next time you feel the urge to splurge, hit the brakes. Give yourself a cooling-off period – maybe a day or two – before making any big purchases related to your hyperfocus. It's amazing how a little time can turn impulse buys into well-thought-out decisions.

- Rally Your Squad: You don't have to tackle hyper-fixation and finances alone. Reach out to friends, family, or even a financial advisor for support and accountability. Share your money goals and struggles with them, and lean on them when you need a reality check or a gentle nudge in the right direction.

Conclusion

Living with ADHD hyper-fixation is like riding a wild rollercoaster, especially when it comes to your finances. But fear not – with a bit of savvy budgeting, a dash of self-control, and a sprinkle of support from your squad, you can keep your money on track while still enjoying the ride.