An honest review of the top budgeting apps for people with ADHD

Discover the best budgeting apps, and how useful they are for someone with ADHD

Why would someone with ADHD need a budgeting app?

For many people with ADHD managing money can feel like an uphill battle. We live in a society where everyone is trying to capture our attention and our wallets. If you struggle with symptoms such as time blindness, impulsivity and poor planning, then it can make things much harder.

Those with ADHD are:

- 4x more likely to impulse spend

- 3x less likely to stick to a budget

- 3x more likely to be in debt.

Let's face it, traditional budgeting with spreadsheets can feel like a chore and I couldn't think of anything worse.

I decided to explore some of the popular budgeting apps in the market to give a personal view of how they could help someone with ADHD manage their money (if at all) and give my thoughts on them.

Full disclosure: I'm actually building a money app for those with ADHD. So you might want to take my opinion with a pinch of salt, but it's an honest appraisal of my experiences.

Reviews at a glance:

Best for Zero Based Budgeting: You Need a Budget (YNAB), £12.99 P/M or £86.99 P/Y

Best budget friendly app: Snoop, free or premium features for £4.99 P/M

Best for money splitting: HyperJar, Free but fees for transfers

Best for savings: Plum, Free basic account with varying subscriptions ranging from £2.99 to £10.99

Best for gamification: Rule, free to use with some premium features

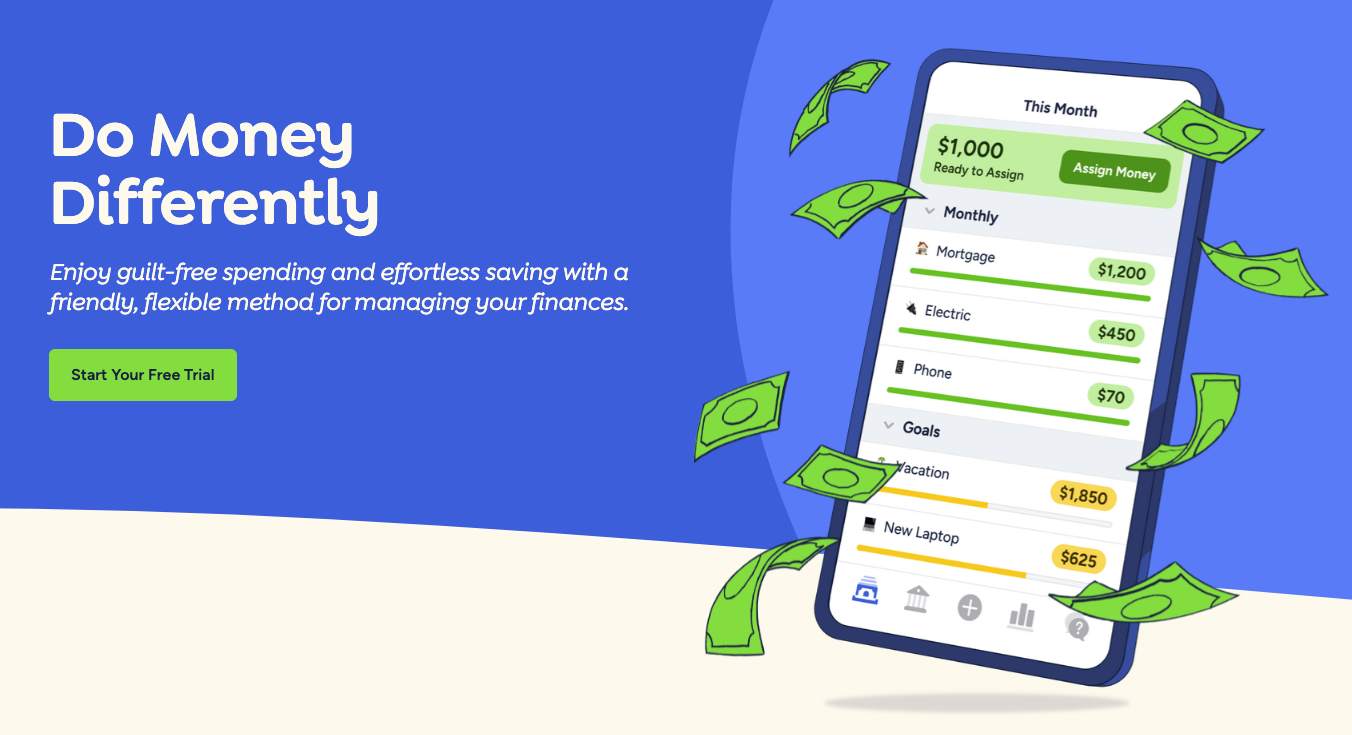

You Need a Budget (YNAB)

YNAB follows the 'Zero Based' budgeting method of managing your money. Every single pound in your incoming and outgoings is accounted for or, in their words has a job. With this method, the accuracy with which you can manage your monthly incomings and outgoings is very high, which can bring a strong level of confidence to those who use the app. One downside is that the commitment to get it working is also somewhat high.

The first thing you have to do before going anywhere is agree to a free trial. YNAB hasn't got a free option, it's only paid. This is balanced with them having a longer than average free trial period of 30 days to see if you like using the app. The cost of a subscription isn't cheap either, sitting at £12.99 per month. I don't see the cost as a huge issue because if you use the app, you should cover this and more via savings made in your spending behaviour. I also think the free trial is generous.

When setting up the app you need to answer a bunch of questions about your spending behaviour and goals. These don't feel too annoying or intense and actually were quite thought provoking.

This is where the ease of set-up ends. You have two options with the app. One is to use OpenBanking technology to pull in data from your bank or alternatively you can use the app manually. I would strongly suggest using OpenBanking. The setup of getting the app to a place of usefulness is hugely time consuming. The apps UI is also super overwhelming, which for someone with ADHD can be a major turnoff right out of the gate.

All that being said, once you do get over the big set-up hurdle, that's where things start to pay off. Once the product is up and running, you gain a profound sense of confidence from knowing exactly where every pound is going. Even if you overspend in one category in a given month, you simply take it from another category where you underspent. It really instills discipline and accuracy in understanding the monthly cadence of your money.

YNAB is basically a digital version of a spreadsheet, and feels just as involved at times. I think for most people who are not optimising, or who maybe become overwhelmed quickly with lots of information, this might be too much to handle and maintain. If you can slog through though, it certainly works.

Pros

- Long free trial

- Super accurate

- Proactive and involved

Cons

- Relatively expensive

- Overwhelming at times

- Intense set-up before it becomes useful

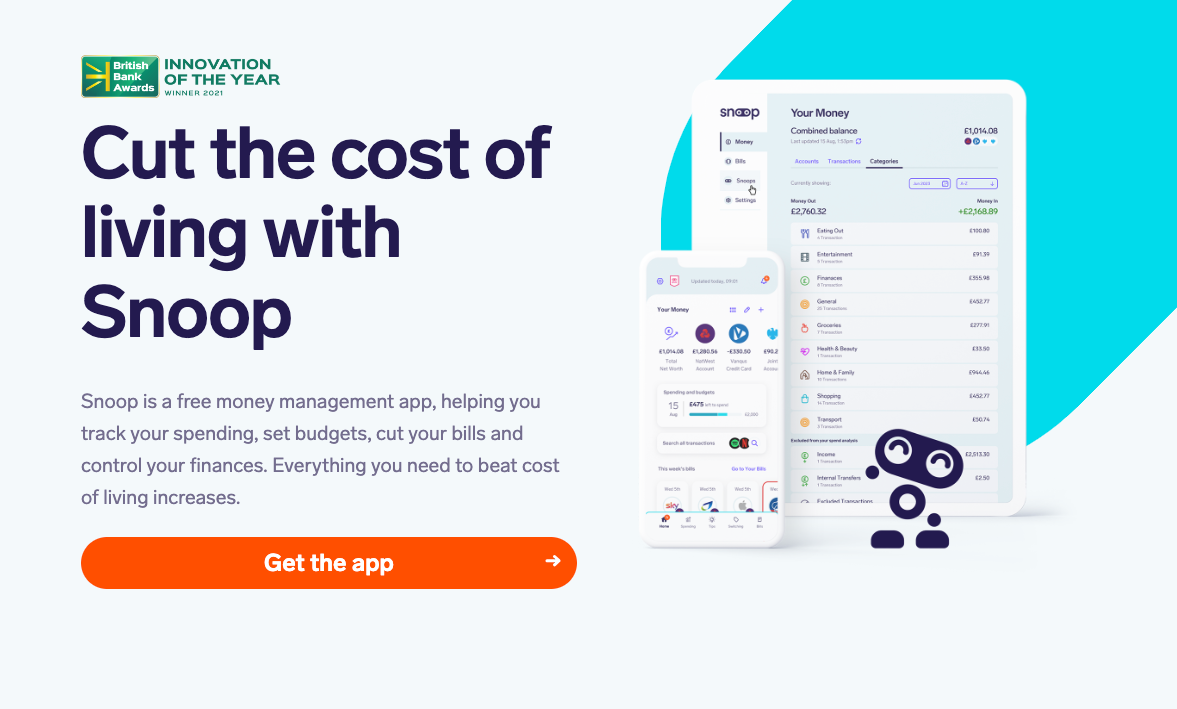

Snoop

Snoop focusses heavily on saving money via tracking your spending / budgeting as well as your ability to save you money on your current bills. The app really sells you on how you won't need to think as the little robot will do all the work for you. Simply sit back and watch yourself save money on bills at the right time. The App is mostly free, though they do have a premium option for £4.99 which is mostly around personalising the app categories.

The initial onboarding set-up was super easy and user friendly. It didn't take much time or thought and actually was pleasant, particularly with the personal feel via the little robot avatar. The app requires you to connect via OpenBanking to be able to use the app, but this was pretty seamless and not an issue. I particularly loved the gamified onboarding after you connect your bank. The app asks a series of questions about your spending in the last year, with multiple choice answers. It was a really fun way of gaining an awareness of how little awareness I had!

Once I hit the landing page, the focus from the get go was on priming me to use the app for switching providers. I found this annoying personally. What I want from a budgeting app primarily is gaining confidence and control over my spending. What I don't like is that everywhere you look there is an option to go search a marketplace for new offers. This feels particularly bad for ADHD as it’s overwhelming, distracting and could lead to an impulsive decision.

Onto the budgeting features we go. I have to admit I didn't find the data particularly useful. The main reason for this is that the auto-categorisation was woefully inaccurate, meaning that the information was not useful straight out of the gate. I also couldn't really see where I was supposed to be focussing. When you go to recategorise it's actually a long drawn out process, which isn't much quicker than YNAB and I lost focus immediately (unsurprising I guess).

Generally it's hard to know where to look, there is just a lot going on which makes it difficult for someone like myself with ADHD to focus. What is the exact information I need to know? One of the promises was that I would have new offers on bills at exactly the right time. In reality the offers are everywhere in the app at all times and feel like fairly generic spam.

The most useful little feature was the bill timeline. It was super simple and told me exactly what I needed to know (which of my recurring payments have already been made and which are due to be paid still). I can't tell you how often I have to manually check this because I forget.

Overall I would say it is more visually appealing than YNAB but actually much less useful for someone with ADHD.

Pros

- Free to use

- Easy set-up

- Lovely bill tracking feature

Cons

- Overwhelming screen

- Terrible auto-categorising

- Irritating offers everywhere

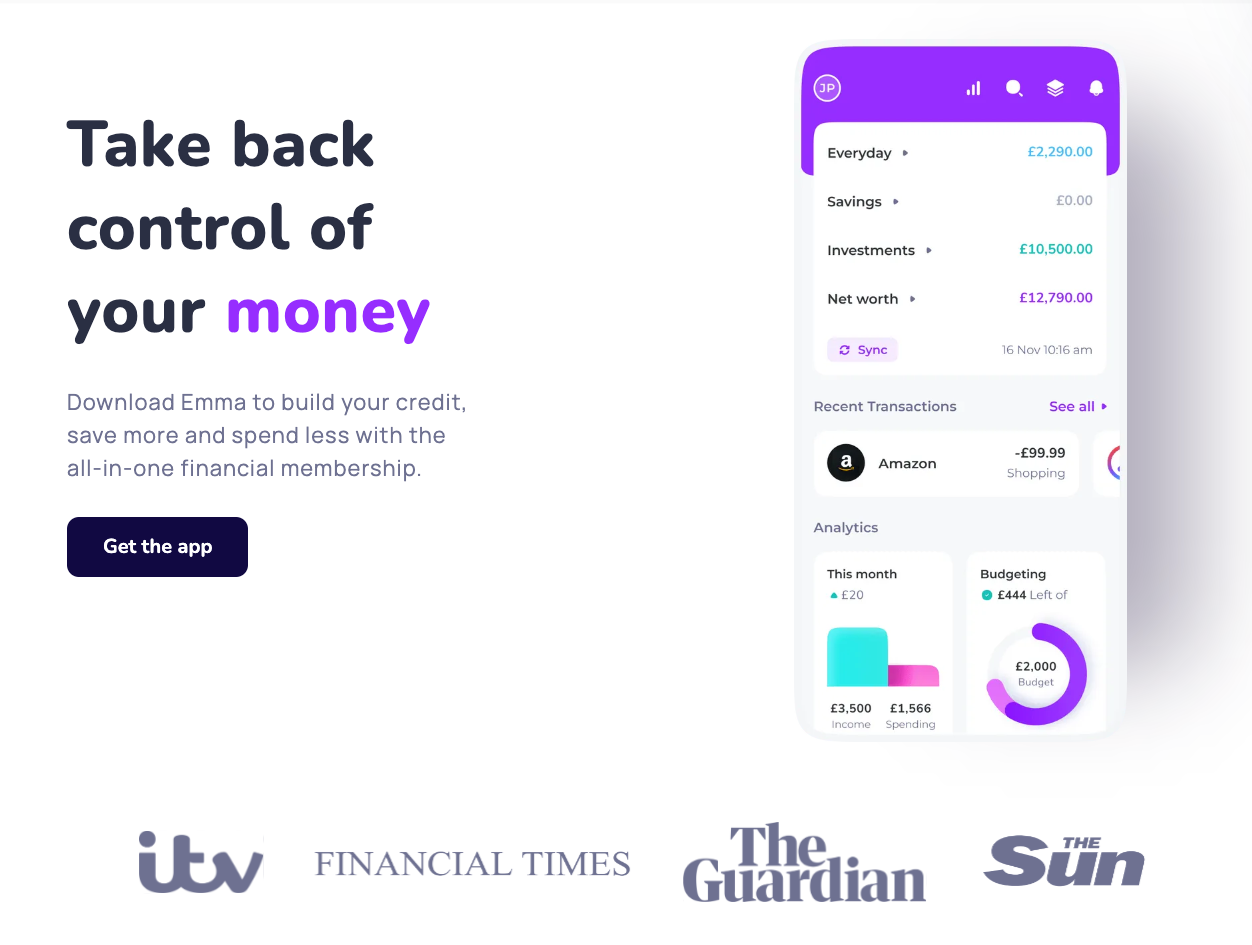

Emma

Emma used to be a pure budgeting app but they seem to be moving towards a 'financial super-app' that can do everything in one place. This is actually to their detriment in many ways, but we will get into that.

The onboarding was super simple and smooth without too many headaches. Much like Snoop it requires an OpenBanking connection to be used, and this promises to make everything much simpler. I did get annoyed right at the end of Emma's onboarding. They have a pop-up asking you to agree to a week long free trial, followed by a paid subscription. What isn't clear is that there is an entirely free version you can use. Once I finally found the X button on the screen, then it offered free vs premium. I thought this was a misleading way of getting new subscribers, and particularly for people with ADHD who are more likely to forget a free trial.

Once I hit the landing page, the first thing was an offer of an app tutorial. The app tutorial was 11 steps long, and wasn't particularly easy to understand. I think it is concerning when an app needs tutorials of this length, as it could indicate that the UI leaves a lot to be desired, but it is particularly concerning when the tutorial is also confusing. Turns out this was the case. The landing page was pretty overwhelming for me, with tonnes of information that I couldn't easily sift through. In addition, every single tab had a red notification icon. I find these icons stressful at the best of times, but it felt like an aggressive way of getting me to explore the app.

Once I got past this, it really felt that the app was just on constant upsell mode, I couldn't look anywhere or go anywhere without an offer of a product or a subscription which made the whole experience feel like a sales page.

The budgeting features are fairly lightweight but the incoming and outgoing graph was easy to read and useful. It does suffer from the same issue as Snoop however, which is that the categories are really inaccurate, leading to a lot of time wasted putting things in their right places. Setting up a budget was simple, with an amount you want to spend and the time periods. You then need to set a budget for each category which is a light version of YNAB. It also isn't particularly useful as it requires a lot of work trying to think through each category without any prompting. Once I had finished this exercise, another pop up to upsell me a paid subscription for £6.99 per month. Turns out I can't actually set a budget without paying. Putting all the work in, to discover it was wasted without spending money wasn't a lot of fun.

The tabs are focussed on financial products such as savings, paying others, investing and loans. There are also marketplace options for utilities available. If you are already using Emma for budgeting, I can see how having these products could be useful as an 'all in one place' type of vibe. They seem easy to set up and use, so I don't have anything negative to say about them.

Overall, I think Emma as a free app isn't great. You really need to be prepared to use the app for your savings, investments and borrowing to get any real use out of it. I think a lot of people with ADHD would find it too overwhelming and would lose motivation fairly quickly.

Pros

- Easy set-up

- Some nice graphs

- Pretty good savings rate

Cons

- Overwhelming screen

- Terrible auto-categorising

- Irritating offers everywhere

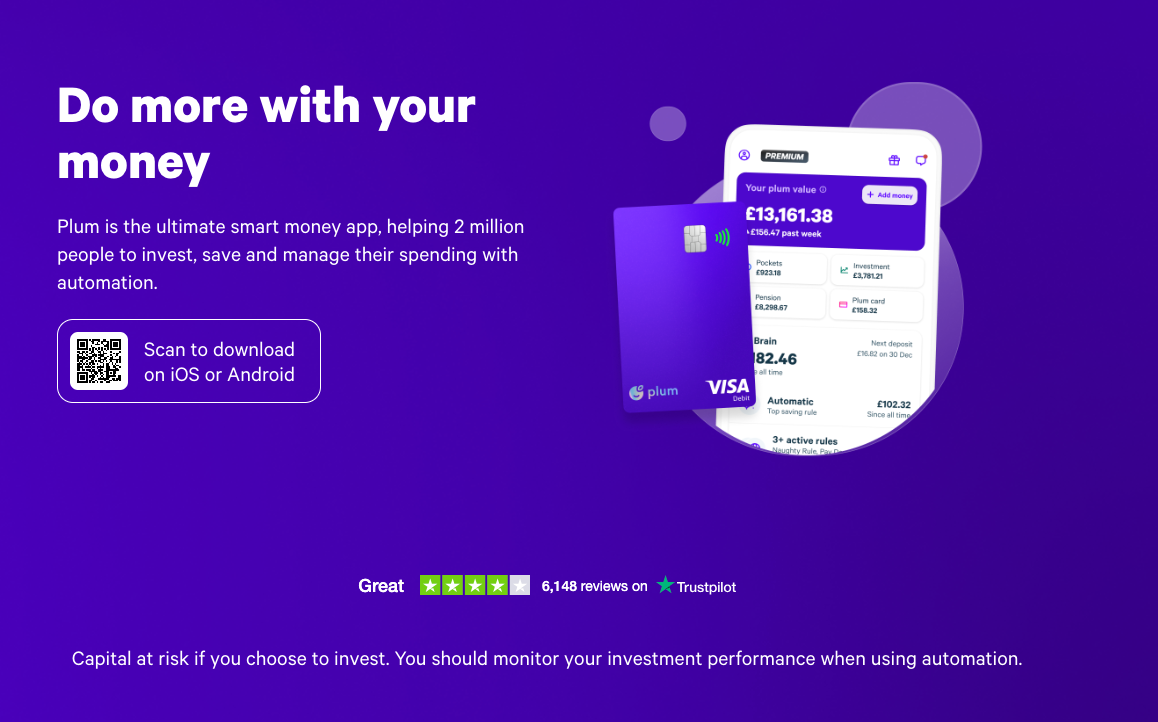

Plum

Plum is a money management app that automates savings, investments, and offers insights into your spending habits. Their key selling point is their automated savings features that really take the thinking out of saving, it just happens.

Set up of this app was super easy, and it uses data through OpenBanking to calculate a suggested savings rate. Once you agree, then the app will automatically take the money from your account without you even having to think about it. I found it a super easy way to build up a savings pot. If you are someone with ADHD, this happening without you thinking about it can be powerful.

One negative of this is that the app constantly reminds you of how much you have saved via notifications. This can be useful for motivation, but it also acts as a reminder of a potential impulse spending pot I have sitting around. With ADHD, out of sight very often is out of mind. So sometimes, it is better to be reminded less but I am nitpicking here. One downside of the automated side of things is the accuracy of how much you can afford to save. Sometimes it massively overestimates or underestimates which can dent the confidence of knowing it will take just the right amount.

There are loads of options of where you can put the money you saved, from ISAs, to cash accounts, pensions or even stock market investments. This is really helpful in building up a varied portfolio and broadly is simple and easy to set up and use.

Cost wise, you can get a lot from the basic plan which is free. The premium subscriptions range from £2.99 to £9.99. Additional features range from more fun challenges when it comes to auto savings with additional 'pots' to split your money into right up to getting access to the Plum Debit card with cash back features. You can also access slightly higher interest rates with paid subscriptions. Overall though it feels like unless you are optimising, the basic should cover most basis for a standard saver.

Pros

- Easy set-up

- Good savings options

- Automated

Cons

- Sometimes inaccurate savings amounts

- Fees can be quite high

- Another debit card I probably don't need

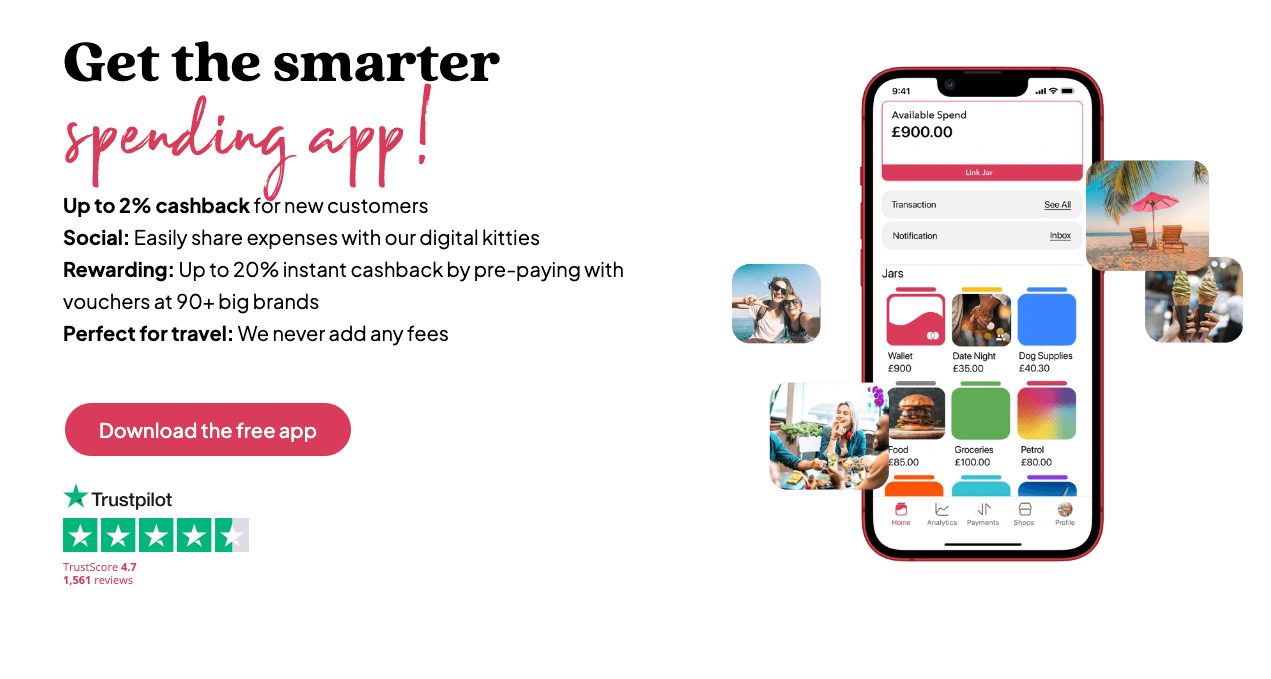

Hyperjar

Hyperjar is a budgeting app that allows users to manage their money using digital “jars.” Each jar can be assigned for different purposes such as bills, groceries, savings, and more. The app also offers features like shared jars for group expenses and discounts with partnered retailers. This is really taking the popular budgeting concept of 'enveloping' and digitising it.

The jar system is a really nice way of visually allocating your money. It is pretty similar to Monzo's pots, but for traditional banking users it is a great alternative. Splitting your money up to be able to see in real time how much is left of the money you allocated for a specific purpose is nice and not too overwhelming. The app also comes with a debit card meaning you can spend directly from any of your pots for that particular purpose. A particularly useful features of the pots for someone with ADHD is the 'only and never feature'. If you know you have a tendency to impulse spend, you can set a rule that means you can only access the money in a predefined circumstance or never access the money. It is up to you but it can really help protect you from yourself.

When it comes to the rest of the app I find it all a bit busy with so much going on. It seems to be a common theme that a lot of other stuff is tacked on to offer you that generally isn't that useful. Features like gift cards and vouchers feel like they go against the ethos of reducing spending. If you are impulsive by nature, seeing these shiny offers can make it difficult to ignore and might actually increase your spending.

I haven't really taken the time to use the family card features, complete with a card for your kid. This is mainly because it isn't relevant for me but on the face of it, it looks like a nice way of teaching your child about money and also keeping your finger on the pulse of the family finances as a whole.

Pros

- Easy set-up

- Jars are really nice way of visually splitting money

- Card to spend from specific jars is useful

- Like the rules on particular jars

Cons

- Bloated with other shopping offers

- Rewards and cashback incentivise spending

- You get a lot of these features from Neobanks

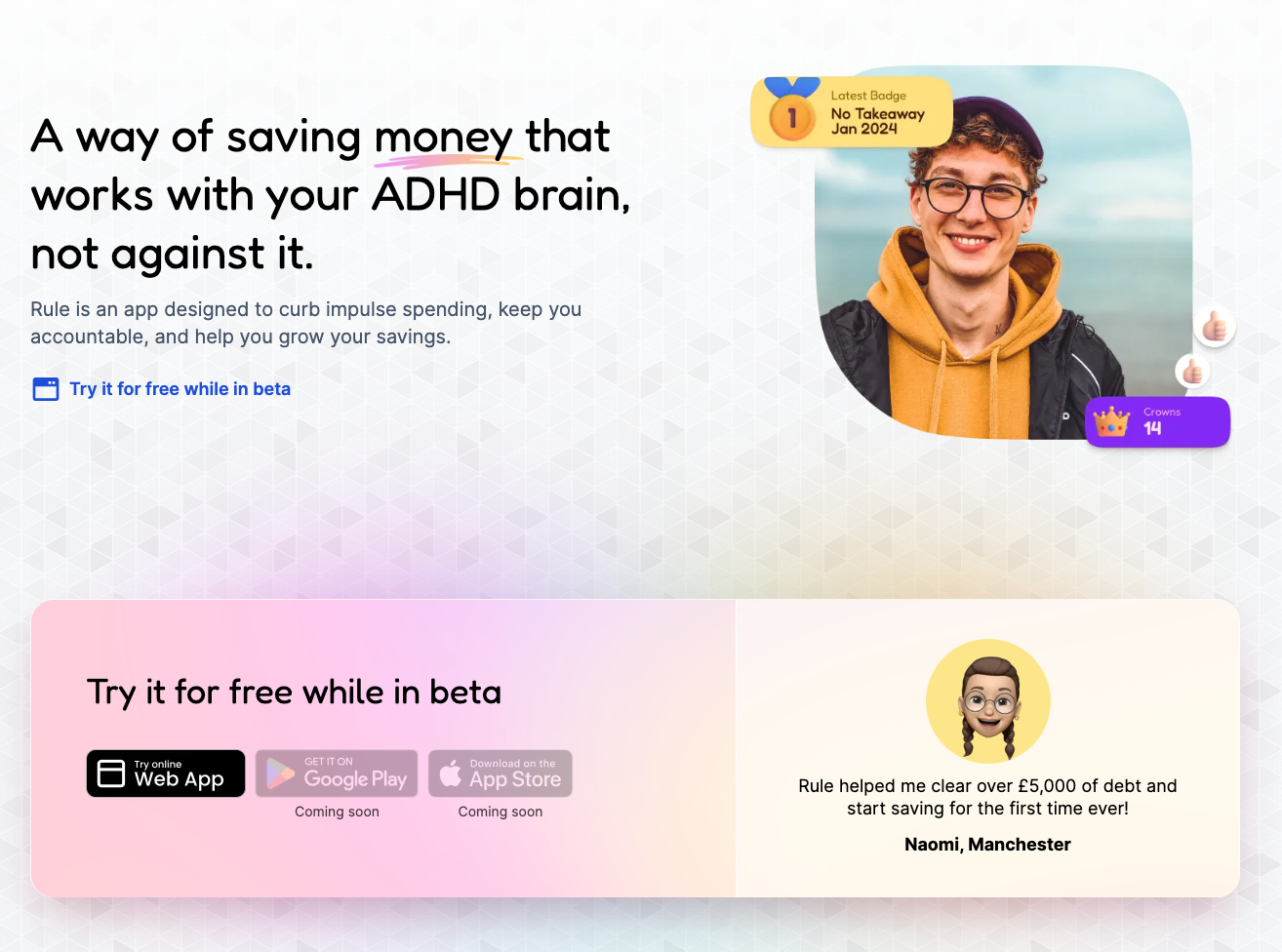

Rule

At Rule we're building the most engaging money app by turning the daily management of money into a game. We're building an app designed specifically for people with ADHD to help them manage their money in a way that works for them. Comparing our app to the other apps on this list doesn't really work as it's designed to be something completely different. We believe the majority of money apps are designed for 'optimisers'. Those who already are confident with their money and want to get even better or reduce a little of their workload. With Rule, we wanted to rethink everything.

We do this by making everything bite sized, digestible and challenge based. We’ve turned budgeting into simply swiping through a few transactions each day. After this we challenge you to save a small random amount so that each time you put in work you’re also building your savings.

We’ve been building this with our ADHD & money community and people are loving it.

Just been having a check-up on the savings made since the takeaway challenge I participated in. I've tried to stick with it, and yes, I have succumbed on a few occasions. BUT...absolutely mind blown that I've already saved over £3,000!

This is all tied together with a virtual pet. Doing well in the app and with your money, means your virtual pet does well too. They can help keep you on track and accountable too!

For us, building motivation via simple daily habits and actions, as well as the motivation required to continue is what is really required to support those with ADHD. We focus heavily on your habits and behaviours, as a method for curbing impulse spending and changing behaviour.

We believe that to support people with ADHD it requires a totally different approach for long term financial wellbeing and confidence. But we can’t build it alone, please try it out for free and give us feedback!